Who will survive when the 'everything bubble' pops?

We live in uncertain times, the cheapest money in history is coming to an end. Let's look at what that means for the 'everything bubble'.

When the first Covid lockdowns started in March 2020, the stock market and bitcoin tanked. No one knew how dangerous or harmless this virus would turn out to be, and what the implications of shutting down a globalized economy would entail. To me, it didn’t make sense. So I bought the dip.

What followed in the course of the next 2 years was unprecedented on many levels. Governments and central banks jumped in, fresh money became accessible to literally anyone who was able to put a signature under a document, and what we got was the cheapest funding environment ever.

This resulted in an everything bubble, where anything from real estate, to meme stocks, index funds, bitcoin, and thousands of cryptocurrencies blew through their all-time highs and put people in euphoria. It didn’t matter what you invested in, just buy something and wait for ‘number go up’. Everyone’s a genius. Happy times.

Things got so crazy that every idiot who made some money with the above-mentioned investments started to look into investing in LEGO sets, buying a Rolex watch, spending ridiculous amounts of money on vintage Nintendo games, and hell, there are now even startups where you can buy fractions of Nike sneakers. And then we also have pictures of pixelated rocks or randomly generated monkeys. If you thought the ICO mania of 2017 was crazy, you weren’t ready for 2021 and beyond. This is definitely some shit for the history books, even if things like vintage collectibles and NFTs are here to stay in a less mania-driven way.

In this ‘as-long-as-money-stays-cheap-you-win’ and ‘number-go-up’ environment tech and crypto companies were able to raise absurd sums, in a lot of cases without even having a product and just the vague idea of doing something with Web3, NFTs, and so on. VCs had so much money, they didn’t really give a shit. Do three companies have the same idea? Let’s invest in all three of them.

Cheap money is (probably) coming to an end

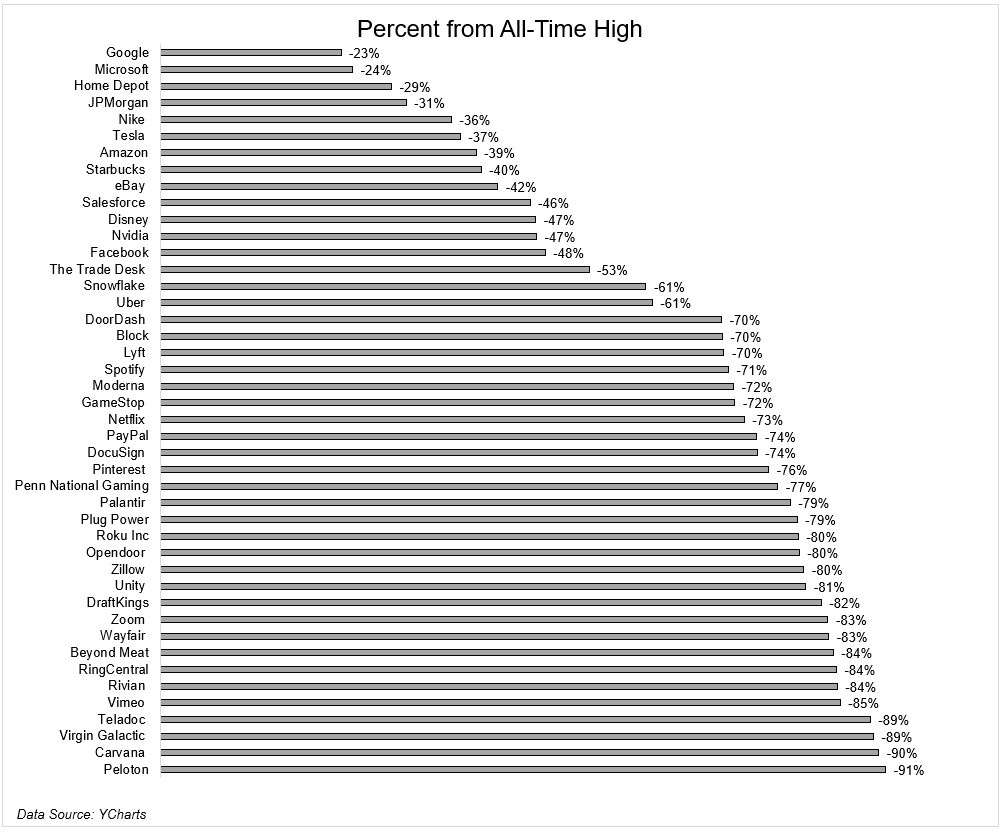

What happens when endless cheap money stops pouring in and interest rates for dirty fiat goes up? Risky assets start to bleed. Coinbase, the most popular crypto broker in the world, already announced that they’re slowing down hiring. But also tech and especially growth stocks are going down. As Izabella Kaminska wrote in her excellent anaylsis, things are quite similar to when the dotcom bubble started to pop: The Fed started to tighten in May 1999, the dotcom bubble peaked in March 2000.

Now, the Fed announced the biggest hike in two decades, the ECB will most likely follow in July. Of course, there are a lot of uncertainties. Super loose monetary policy is definitely a factor (don’t forget that inflation was at 7.9% in the US before the war in Ukraine started and Biden’s team invented “Putinflation”), but there definitely are supply chain and war-related factors as well. Sanctions against Russia; Russia “weaponizing” its energy; the possibility of the war escalating; China’s stupid Zero-Covid strategy (that could also be economic warfare, but who knows) … there is A LOT of uncertainty in the air right now.

But the Fed and the ECB are in a tricky position: Keep interest rates low and inflation will run even hotter. Stagflation with high-interest rates and a shrinking economy is what follows. Meaning prices of stuff continue to rise, while you have a lot of unemployed people. No one wants that, especially not short-term-gain politicians. Extreme political positions become more popular, which will end in suffering for all of us as history has taught us. We don’t want that.

The alternative is to raise interest rates and risk a recession, which is also shitty but probably needed in order to not finally fully blow up the financial system. Problem is that in a recession you’ll also have a lot of unemployed people, failing businesses, a shrinking economy. The solution is usually to lower interest rates and follow good old Keynes’ fiscal and monetary counter-cyclical policies, aka spend more government money when the economy is shit and less when the economy is good.

You see: It’s complicated and no one really knows, even though politicians and their favorite economists tell you so. It’s similar to the crypto industry as a whole: I’m very skeptical about nearly all the crypto assets out there (except bitcoin and the handful of things with an actual use-case, mainly exchange utility tokens).

This brings us back to Izabella Kaminska’s article: The wipeout of the crypto market in this environment could actually be good, similar to how the dot-com burst wasn’t the end of internet companies.

“Instead of being the death of the market, this might be more analogous to when internet stocks transitioned from their own speculative phase over the course of the 1990s to the practical deployment period of the 2000s, eventually paving the way for the successes of Amazon and Google. Even so, the market must acknowledge some uncomfortable truths first. The key one is that some 95% of the market, or more, is probably worthless — largely the product of a ridiculously cheap funding environment driven by excessively loose central bank policy”, Kamiska writes.

According to her, the phase of experimentation is over, and the “blockchain/crypto/web3 is a solution looking for a problem” narrative will be tested for good. This won’t be pretty.

This time it’s different … not really

The similarities between the dot-com bubble and today are striking: “It’s worth remembering that the dot-com craze was largely financed by the capacity of entrepreneurs to print their own money in an accommodating market. Rather than issuing cryptocoins, they floated company stock on public exchanges or paid out salaries in equity options. The end effect, however, was largely the same. What transpired was a mass injection of private sector financing, backed by public goodwill, into largely experimental concepts. Many of these concepts were not wrong, just ahead of their time.”

As Kaminska points out, however, we now have more problems to solve than ever. And it’s more than just the best place to buy stuff on the internet or where to search for cooking recipes: “To name just a few, the de-neutralisation of the dollar because of Russian sanctions, the rise of a multi reserve-currency world, growing authoritarianism, war, de-globalisation and the emergence of “friendly” and “unfriendly” trading counterparts. Many parts of the crypto world are well positioned to take these challenges on. That means now is the time to assess the market from the perspective of utility. In the current environment, it is possible that any crypto that can help build bridges with enemies, protect privacy, better allocate resources to those in need or generate energy savings will prove successful in the long run. But expect a very rough ride in the interim.”

The big picture: a new monetary order

The big picture is what excites me the most. As Zoltan Pozsar pointed out in his Bretton Woods III thesis, is that we’re entering a new monetary order. The seizing of Russia’s foreign exchange reserves marked a turning point in geopolitics. It showed everyone: Your dollars are only worth something as long as the G7 (and especially the US) say so. China, India, and others took notice.

In his report, Pozsar writes: “We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West”.

“When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities,” Pozsar wrote. “After this war is over, ‘money’ will never be the same again…and Bitcoin (if it still exists then) will probably benefit from all this.”

Sorry to disappoint, but I have no clue what’s next. Which stock to buy or who’ll win this crypto race and who the next Amazon or Google will be. There are 20k cryptocurrencies out there, and countless NFT projects. Pick some, and you may be lucky. Just know that 99% of them will eventually go to zero, maybe more. Note that the remaining 1% out of 20k crypto assets are still 200, which is A LOT for my taste. Bitcoin is risky as well of course, but as Pozsar has pointed out there is a chance that it could come out as a winner out of all this uncertainty.

By the way, Poszar thinks that the Fed will continue with Quantitative Easing in Summer 2023. So maybe our rock JPEGs will moon again by then.

Photo by Lanju Fotografie on Unsplash.

This newsletter reflects the author’s opinion and is intended for educational and entertainment purposes only. Be aware that this newsletter should not be considered investment advice in any way. Investing in Bitcoin and other assets is risky. Please be careful.