From Zero To Hero To Zero - WTF FTX?

Sam Bankman-Fried aka SBF went from celebrated crypto-wunderkind to fallen crypto oligarch in just a couple of days. Here's what has happened so far.

Keeping up with all the drama and craziness surrounding the downfall of FTX, FTT, Alameda Research and SBF himself is not easy these days. While many people were skeptical about the Bahamas-based exchange, it’s worth it to do a quick recap of how FTX became the second-largest crypto cas…, sorry exchange, how it ultimately collapsed, and what I think is going to happen next.

Some FTX (pre-)history

Alameda Research, a ‘quantitative trading firm’ is founded by Sam Bankman-Fried (SBF) in November 2017. SBF just left his day job at the Wall Street trading firm Jane Street Capital, where he traded international ETFs.

In May 2019, in the midst of a crypto bear market, the then 27-year-old SBF and ex-Google employee Gary Wang founded FTX, a cryptocurrency exchange similar to the likes of e.g. Kraken or Binance.

Changpeng Zhao (CZ), CEO of the crypto exchange Binance, purchased a 20% stake in FTX half a year after Bankman-Fried and Wang started the company for about $100 million. Back then, Binance said the goal of the investment was to “grow the crypto economy together”.

In August 2020 FTX made waves in the crypto industry by acquiring the cryptocurrency portfolio tracking app Blockfolio for $150 million.

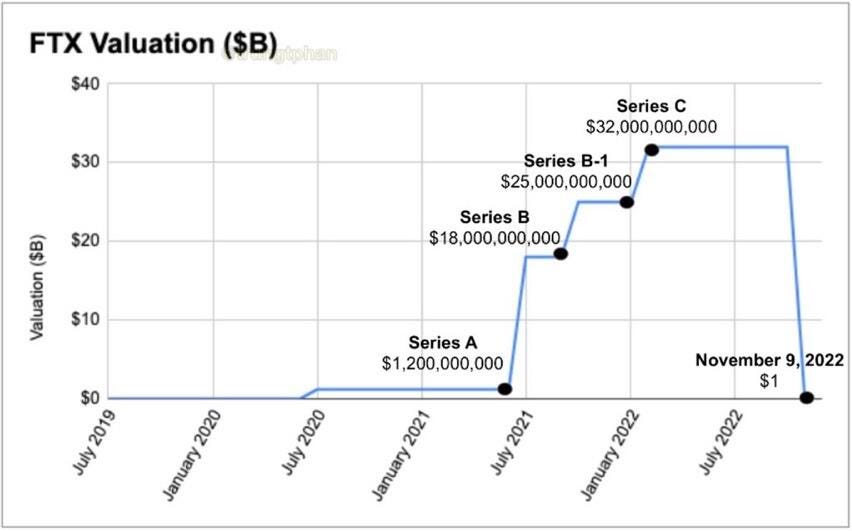

In July 2021, in the midst of a Pandemic-induced crypto bull run, FTX raised $900 million at a valuation of $18 billion, including big VC names like Softbank and Sequoia Capital.

FTX moves its headquarters from Hong Kong to the Bahamas in September 2021. In January 2022 the company launches a $2 billion fund called FTX Ventures. Investments of FTX Ventures included among others ‘Bored Apes’ creator Yuga Labs, USDC stablecoin issuer Circle, and crypto lender BlockFi.

In January 2022 FTX also raises another $400 million in a Series C, now valued at a staggering $32 billion.

In early 2022 both FTX and SBF were suddenly everywhere. SBF became what Vitalik was during the 2017 crypto hype: The nerdy wunderkind, who was smarter than everyone else.

Especially US media LOVED SBF. A white rich kid, who - according to Wikipedia - was “born in 1992 on the campus of Stanford University into a family of academics” was exactly the kind of story you needed for clicks during the 2020/21 crypto bull run.

What made SBF even more likable among journalists and ‘the establishment was the fact that his whole family seems to be well-connected progressives.

SBF was actually the second-largest donor (!) for the US democratic party in the election cycle of 2021-2022.

Videos like the one below started to emerge. We learned that SBF is vegan, that he sleeps 5 hours a night, and that he’s a billionaire who wants to donate it all to charity.

If you like cringe, feel free to watch this:

In February 2022 FTX.US, the US focussed arm of the company, announced that they will soon offer stock trading to US users.

FTX was among the sponsors of the Super Bowl LVI, that took place in February 2022. Their ad featured actor and comedian Larry David, who’s lines seem prophetic:

“Like I was saying, it’s FTX. It’s a safe and easy way to get into crypto,” an actor portraying an FTX executive tells David in the ad. “Ehhhh, I don’t think so. And I’m never wrong about this stuff – never!”

How CoinDesk (And CZ) took down FTX

On November 2 CoinDesk published an investigative story on FTX.

In it, it became clear that the trading-firm Alameda Research, founded by Sam Bankman-Fried (SBF), who also happens to be the CEO of FTX, rests largely on the foundation of FTT, FTX’s exchange token SBF himself created out of thin air.

This house of cards started to collapse when Binance CEO CZ tweeted that his company was planning to sell its FTT, which was largely interpreted as a lack of confidence in the company’s health, as Binance was among the earliest investors in FTX.

Fast-forward a few days, and it looks like Alameda, FTX, and FTT are going down for good. The latter lost most of its value, going down from around $25 last week to around $3 this Friday.

Over the course of the week, we learned that FTX used user funds for risky gambles, and that 28-year-old Alameda Research CEO Caroline Ellison probably didn’t know what she was doing.

FTX announced that they are bankrupt on November 11, 2022. SBF stepped down from his role as CEO.

The silver lining

To be honest, I think actors like FTX getting washed out now is way better than if they had stuck around longer. Same with Celsius, same with LUNA and whoever will follow in the next couple of weeks and months.

I see three positive things emerging out of this:

Another reminder about ‘Not your keys, not your coins’, plus a reminder that crypto tokens are out-of-thin-air assets and dependent on some kind of company, person or trust to make them work as a speculative asset. In FTT’s case some tweets by CZ were enough to send their price south.

Exchanges are FINALLY willing to do their homework by conducting Proof of Reserves. I doubt that this will be enough to stop centralized exchanges from going under in the future, but it’s a step in the right direction. Note that players like Kraken and Nexo already started to that earlier (which doesn’t mean that you can 100% trust them).

More ponzis, bad actors and crypto players that are ‘swimming naked’ are hopefully getting flushed out.

Some fun theories

CZ took revenge and waited for the right moment to kill FTX:

SBF and Gary Gensler:

Like what you read? Send this newsletter to a friend, subscribe (if you haven’t yet) and follow me on Twitter.

Title image by Matt Hearne on Unsplash.

This newsletter reflects the author’s opinion and is intended for educational and entertainment purposes only. Be aware that this newsletter should not be considered investment advice in any way. Investing in Bitcoin and other assets is risky. Please be careful.

Nice piece Raphael , I will recommend and cross- post

Nice piece Raphael , I will recommend and cross- post